Randall Wray on Necessary & Sufficient Conditions in Economics July 5, 2014

Posted by larry (Hobbes) in economics, Logic, money, Philosophy.add a comment

In a recent post about debt-free money, Randy Wray makes some remarks about the relationship between the role of taxation and the movement of the monetary circuit. It is my purpose here to explore the character of this relationship from a logical perspective. Wray contends that taxes are a sufficient but not necessary condition for driving the monetary circuit. As his comments were not entirely clear to me, I asked him what he meant. Among other comments he made, which we will get to, he made these remarks.

If I said “taxes are a necessary and sufficient condition” then that means you must have taxes and nothing else will do. I don’t say that.

If I said taxes are a necessary condition, then that means you must have taxes, but maybe that alone is not enough. I don’t say that.

If I say taxes are a sufficient condition then that means if you have taxes you will drive a currency. However something else might drive it, too.

I think these statements are relatively clear even if not entirely logically so. In order to show what I mean by this, let me specify, how, logically, necessary and sufficient conditions are specified. First, we have a variable, x, that ranges over taxes. Now, we are in a position to specify the exact character of necessary and sufficient conditions relevant to Wray’s concerns.

Sufficient condition (for tax to drive monetary circuit): if x is a tax, then x drives the monetary circuit.

Necessary condition (for tax to drive monetary circuit): is x drives the monetary circuit, then x is a tax.

Necessary & Sufficient condition (for same): x is a tax iff x drives the monetary circuit.

It is probably apparent that my formulations do not quite conform to Wray’s formulations. We can ignore the stipulation about tax being a necessary and sufficient condition for driving the monetary circuit, as it is obviously false. Therefore, we need concentrate only on the other two. First, we must note that Wray is engaged in a complexly compacted argument. Let us take sufficient condition first.

The first sentence is nothing more than a statement of what a sufficient condition is. When he mentions that other factors may drive the circuit, he is merely pointing out that for something to be a sufficient condition for something else, this does not rule out the possibility of other sufficient conditions being operative. He is right about this; it is a logically elementary feature of the context.

When we come to Wray’s discussion of necessary conditions, we encounter a little prolixity. When Wray says that were taxes a necessary condition, this would mean that one must have taxes but that this might not be enough, it is not entirely clear, logically, what he is trying to say. For tax to be a necessary condition,this means that if you don’t have taxes (via an application of modus tollens), the circuit will stop unless some other factor can drive the circuit (like the situation with the sufficient condition). While Wray may be clear what he means, the logical structure of what he is trying to get across certainly isn’t.

However, in denying that taxes are a necessary condition for the movement of the monetary circuit,he seems to be saying more than that if x drives the monetary circuit, then x is a tax, from which follows, if x is not a tax, then x does not drive the monetary circuit. This situation does not allow one to contend, as Wray does, that if taxes were a necessary condition of monetary motion, one must have taxes. Additional assumptions are needed in order to derive this conclusion. Hence, I can do no other than to conclude that Wray’s comments in this regard obfuscate the point he is trying to make. Which I think is a straightforward one. it is that the stipulation that taxes are a necessary condition for the driving of the monetary circuit are false because he denies the implication that if something isn’t a tax, then it doesn’t drive the monetary circuit. From which one can conclude that only taxes can do this driving. Which is false. There are other factors that can drive the monetary circuit besides taxes, such as fines, tithes, and the like.

Taxes as a sufficient condition allow for these additional factors to be drivers of the monetary circuit along with taxes. Hence, Wray’s contention that taxes are only sufficient but not necessary.

Upshot: while the logical structure of Wray’s argument isn’t entirely clear, he is consistent. And the role he assigns taxes vis-a-vis the monetary circuit seems to be more than reasonable.

Public Debt Vs. Private Debt July 5, 2014

Posted by larry (Hobbes) in economics, Philosophy.add a comment

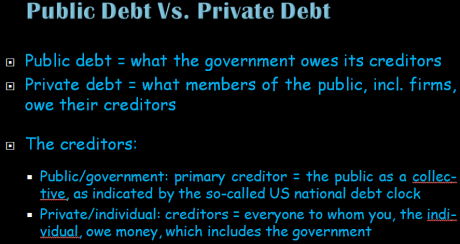

While it can be generally agreed that the terms ‘public debt’ and ‘private debt’ on their own don’t imprint themselves easily on the mind, I think there is a way around this seeming impasse. And this is to link them to simple equivalences. This can be accomplished by emphasizing the direction of the debt relationship. And this can be done quite simply. Public debt = what the government owes its creditors, while private debt = what members of the public, including firms, owe their creditors.

To further spell this out, you can then elaborate who the creditors are in each case. In the case of the public/government debt, the primary creditor is the public as a collective, and this is shown on the so-called US national debt clock (which ought to be called the US national public resource clock). In the case of private/individual debt, there may be many creditors – in short, anyone you owe money to, which would include the government. I am including business firms within the penumbra of the public qua collective for the sake of simplicity. It is important to note that it is not particular individuals with whom the government has this general indebtedness relationship, but the public considered as a collective body. When we speak of public debt in general, it is the public as a whole to whom the government is indebted, not individual members of this public (though such relationships do exist, though not in this sense).

Logically speaking, debt is an asymmetric relationship, analogous, say, to temporal relations. Taking two logical individuals, A and B, to say that the indebtedness relation is asymmetric is to say that the nature of the indebtedness of A to B and that of B to A are distinct in character. Using the general terms, government, creditors, and individuals (persons or firms), we can put the relationships between the three this way.

With G = government, C = creditors, and I = private individual(s) or firms, public debt is one where G is indebted to C qua q, while private debt is one where I is indebted to C qua r, where q and r characterize, in general terms, the two different modes of indebtedness. The characters of the two distinct types of indebtedness are distinct in many ways while simultaneously possessing fundamental underlying similarities. These two modes of indebtedness are logically distinct from one another. The nature of government indebtedness is different in essential ways from the indebtedness of the individual citizen or resident. This difference is captured I think by formulating the indebtedness relationships in this way. The formulation is quite abstract, but that is by necessity.

While the nature of creditorhood in both types of indebtedness may be so similar as to be effectively identical in the two cases, the character of the indebtedness relations themselves will not necessarily be similarly similar (ugh).

When spelled out in this way, it is easy to see that the debt relationship goes both ways but in distinct respects. To reiterate, while there are differences, there is a fundamental similarity and this similarity can interfere with appreciating the differences between the two types of indebtedness relations. Formulating the two distinct indebtedness relations in this way can, I trust, render the differences more salient without allowing the underlying similarity to inhibit understanding the fundamental characteristics of this relationship. Or so I would argue.

Therefore, when the terms, ‘public debt’ and ‘private debt’, are used, they should be considered to be parsed in the way I have suggested above and displayed starkly in the picture at the top. In this way, hopefully whatever confusion there might be between the two terms will vanish or become insignificant. And we can, therefore, go on using the two terms without confusing ourselves.