Some physicists should stick to their lasts July 22, 2013

Posted by larry (Hobbes) in economics.trackback

Here is one of the reasons I think some physicists should recognize their limitations. Forshaw is one of them. Should you have the time to peruse the article, you will find this:

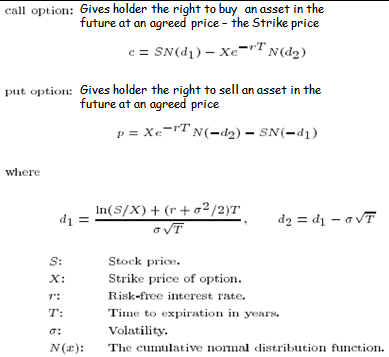

“The most famous equation in finance was published in 1972 and is named after American economists Fischer Black and Myron Scholes. The Black-Scholes equation provided a means to value “European options”, which is the right to buy or sell an asset at a specified time in the future. Remarkably, it is identical to the equation in physics that determines how pollen grains diffuse through water.”

While Forshaw is right to claim that this is a famous equation, he neglects to mention that it is false in its intended application/interpretation. That it is identical to a physics formula rather undercuts the reasons for giving the authors the Swedish Bank prize. For your convenience, here is their formula.

Now, if the market conformed to two of their assumptions, one being central, that of the Gaussian character of the underlying distribution, all might be well. But market distributions are well known by many to be, and have been shown to be, non-normal by Mandelbrot more than 20 years ago. The Cauchy-Mandelbrot distribution, in fact, has no calculable mean or variance, hence no calculable volatility. Which makes it entirely useless for its intended purpose. Thorp came up independently with a similar set of equations to those of Bachelier, mentioned by Forshaw.

However, Thorp’s were initially developed for Blackjack, a situation more similar to the pollen example than that conceived by BSM. He was banned by every casino in Vegas for his trouble. But that didn’t bother him, as he had adequately tested his theory. Or perhaps I should say in this context, his policy recommendations on how to play Blackjack and win. (His recommendations require the player to compute large ratios in their heads, something most of us can’t do. Using a calculator is banned, as they think you’re counting cards which is a no-no.)

I am presuming Forshaw is thinking of Brownian motion, or something along those lines, which makes pollen distribution in a liquid more or less random and approximate a normal curve. Neither of which is true of the market.

What does this sort of thinking say about the burgeoning field of econophysics? Not much that is positive.

Here is the link: http://www.guardian.co.uk/science/2013/jul/21/physics-graduates-gravitate-to-finance.

Just to show I am being even-handed, here is an assessment of market behavior by a physicist and a financial economist, Vasquez and Farinelli. Here is the link:

http://arxiv.org/pdf/0908.3043v1.pdf. They argue that there is geometric curvature and, therefore, path dependence in real market data, something anathema to the neoclassical paradigm.

Comments»

No comments yet — be the first.